Toms hmrc shop

Toms hmrc shop, TOMS Tour Opertator s Margin Scheme VAT Serviced Accommodation UK Property Accountants shop

Colour:

Size:

TOMS VAT calculation examples it doesn t have to be a mountain shop, Tour Operators Margin Scheme TOMS Rent to Rent Business Model shop, Tour Operators Margin Scheme TOMS ACCOTAX shop, TOMS VAT calculation examples it doesn t have to be a mountain shop, TOMS Tour Opertator s Margin Scheme VAT Serviced Accommodation UK Property Accountants shop, Court Decides BOLT s Services under TOMS VATupdate shop, Everything you need to know about serviced accommodation and VAT inc TOMS shop, Bolt Ltd vs HMRC Legal Insights on TOMS Dispute shop, VAT victory for Bolt as HMRC loses case over Tour Operator Margin shop, TOMS VAT calculation examples it doesn t have to be a mountain shop, Tour Operators Margin Scheme TOMS Serviced Accommodation shop, Tom Skalycz HM Revenue Customs LinkedIn shop, TOMS VAT on Serviced Accommodation A Surprise Win against HMRC shop, TOMS VAT on Serviced Accommodation A Surprise Win against HMRC shop, HMRC Pursues Uber for 386m VAT Bill shop, Tour Operators Margin Scheme TOMS BNW chartered accountants shop, VAT Serviced Accommodation It s a TOMS Supply shop, HMRC Pursues Uber for 386m VAT Bill shop, Bolt Ltd vs HMRC Legal Insights on TOMS Dispute shop, Child Benefit Charge Archives Jackson Toms shop, HMRC empowered to name and shame tax evasion enablers Tax shop, TOMS VAT on Serviced Accommodation A Surprise Win against HMRC shop, TOMS VAT calculation examples it doesn t have to be a mountain shop, Tour Operators Margin Scheme TOMS Serviced Accommodation shop, VAT TOMS No repayment for negative margin www.rossmartin shop, HMRC eBay and second hand news Jackson Toms shop, Tour Operators Margin Scheme Crowe UK shop, HMRC to move to new digital ID system in 2023 THINK Digital shop, TOMS VAT on Serviced Accommodation A Surprise Win against HMRC shop, Professor Tom Crick joins DCMS as Chief Scientific Adviser GOV.UK shop, TOMS Tour Operators Margin Scheme VATupdate shop, Newcastle tech firm announces digital partnership with HMRC shop, Is your Serviced Accommodation business eligible for TOMS UK shop, Navigating the HMRC Worldwide Disclosure Facility WDF A shop, HMRC Charter annual report 2022 23 CIPP shop, MPs and VIPs given SPECIAL TREATMENT by HMRC as queue jumping tax shop, Revealed The Whitehall tax sleuth who made Nadhim Zahawi pay 5m shop, The Rt Hon Tom Tugendhat MBE VR MP GOV.UK shop, HMRC customer service plummets to all time low and taxpayers are shop, Tour Operators Margin Scheme Crowe UK shop, Bolt Ltd vs HMRC Legal Insights on TOMS Dispute shop, VAT and property rental rule changes including TOMS Taxation shop, Tom Hartley GOV.UK shop, Is your Serviced Accommodation business eligible for TOMS UK shop, Podcast Tom Read talks GDS s future strategy Government Digital shop, Tom Shinner GOV.UK shop, Using the Right PAYE Reference Making HMRC Payments CIPP shop, Torbay TOMS Framework Torbay Council shop, Tom Parr HMRC International Tax HM Revenue Customs LinkedIn shop, TomHerbert AccountingWEB shop.

Toms hmrc shop

TOMS Tour Opertator s Margin Scheme VAT Serviced Accommodation UK Property Accountants

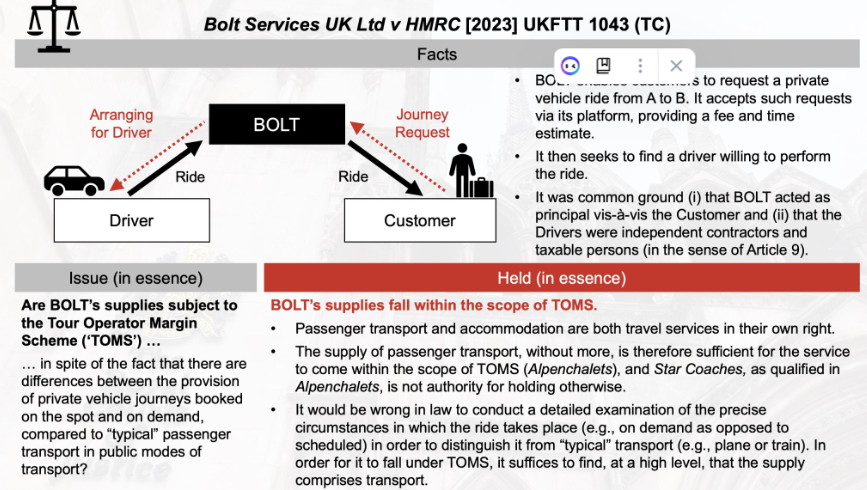

Court Decides BOLT s Services under TOMS VATupdate

Everything you need to know about serviced accommodation and VAT inc TOMS

Bolt Ltd vs HMRC Legal Insights on TOMS Dispute

VAT victory for Bolt as HMRC loses case over Tour Operator Margin

TOMS VAT calculation examples it doesn t have to be a mountain